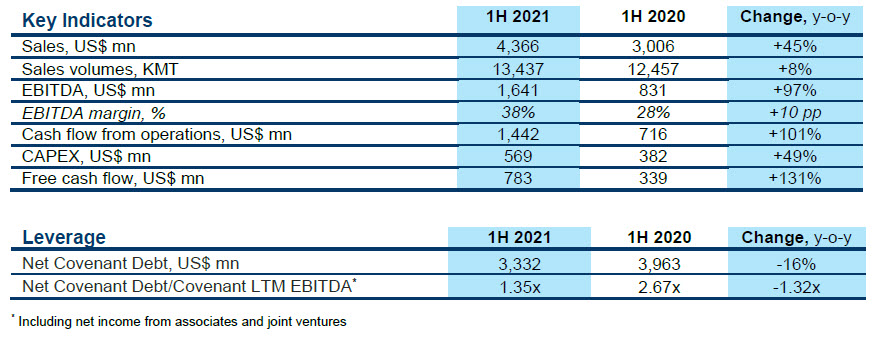

EuroChem posts record 1H EBITDA of $1.6bn

1H 2021 IFRS RESULTS

Highlights:

- Sales up 45% year-on-year with cost of sales for EuroChem products flat

- EBITDA up 97% to record US$1.6 bn on higher output and operational efficiency drive

- EBITDA margin up 10 percentage points to 38% mainly driven by potash sales increase

- Potash sales reached 1.25 MMT, 25% up, with gradual output increase at UKK

- Free cash flow at US$783m, up 131% year-on-year

- Net leverage ratio decreased to 1.35x compared to 2.53x at the end of 2020 and 2.67x a year ago

Zug, Switzerland, August 18, 2021 – EuroChem Group AG (hereinafter “EuroChem” or the “Group”), a leading global fertilizer company, today reported consolidated 1H 2021 sales of US$4.4 billion and sales volumes of 13.4 million metric tonnes (MMT), generating company-record EBITDA for the six-month period of US$1.6 billion, in line with the Group’s ambitious growth plans.

The all-time-high earnings before interest, tax, depreciation and amortization of US$1.6 billion were attributable to increased output from the Group’s production facilities, chiefly potash, iron ore and urea, enabled by EuroChem’s expansive investment program amounting to more than US$6 billion over the past five years.

“While higher prices and favorable exchange rates boosted earnings further, at their core these results reflect new performance levels across all assets prompted by the implementation of best-available technologies as standard, modernization programs at non-new facilities, the introduction of new product lines and an operational efficiency drive to methodically identify and eliminate sub-optimal practices through the value chain,” said EuroChem Group CEO Vladimir Rashevskiy.

Spearheading the company’s growth are two recently introduced world-leading facilities: EuroChem Northwest, the Group’s 1 MMT/a state-of-the-art ammonia plant which has brought self-sufficiency in this crucial fertilizer ingredient; and the EuroChem Usolskiy Potash Complex, which launched in 2018 and is now producing at 2.3 MMT/a with the potential for further capacity increases.

Increases in sales of EuroChem and third-party products have been underpinned by investments in distribution arms across key regions such as Brazil and the United States, providing additional sales channels for products manufactured, blended and packaged mainly in Russia, but also in Belgium, Brazil, Lithuania, the United States, and other countries.

The results come on the back of record high full-year 2020 figures, providing further evidence of EuroChem’s resilience in the face of the global pandemic. They also coincide with a landmark date: August 27 marks 20 years since EuroChem was founded.

“Becoming a top-five global fertilizer company in two short decades is a story of precipitous growth, and one that is without precedent in the industry,” noted Vladimir Rashevskiy. “It makes us truly proud and will undoubtedly propel us to new heights.”

The Group’s cash flow from operating activities, meanwhile, doubled to US$1.4 billion on year-ago figures. At the same time, capital expenditure rose by 49% to US$569 million, as strong market fundamentals enabled EuroChem to develop out the Kingisepp industrial cluster in northwest Russia, with construction beginning on EuroChem Northwest 2, a new 1.0 MMT ammonia and 1.4 MMT urea facility on an adjacent plot. Positive trends across key commodities provide a favorable climate for continued investment in growth projects, given the doubling of free cash flow, year-on-year, to US$783 million.

Sales and market environment

A number of factors in the fertilizers space conspired in the first half of 2021 to drag down supply in the face of near-record demand, resulting in some of the strongest prices seen in recent years. While signs are emerging of greater balance for the remainder of the year, the price environment is expected to remain favorable as the global recovery from the COVID-19 pandemic strengthens and the demand for food climbs.

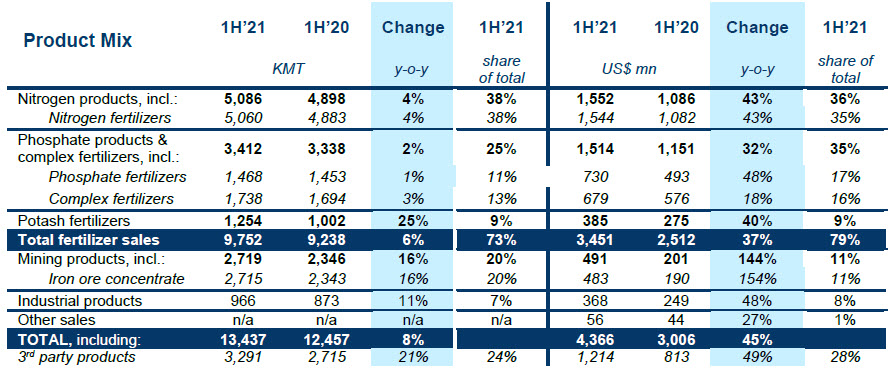

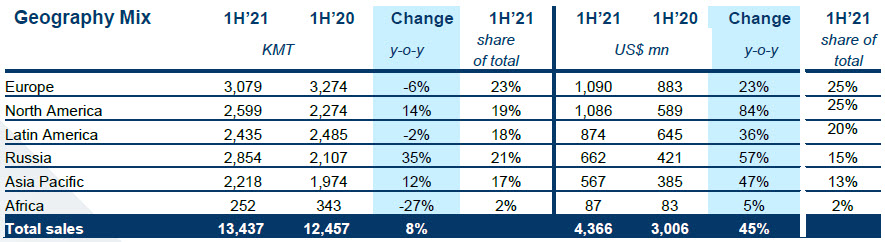

In an unequivocal sign of the strong pricing environment, EuroChem’s sales volumes grew by 8% year on year across all product lines, with potash being the key driver, while revenues were up 45% over the same period. Sales of third-party products through the Group’s distribution and trading platforms were also up 49% in monetary terms. Figures show sales well diversified across key markets, dividing nearly equally in value terms among Europe (25%), North America (25%), Latin America (20%) and significant improvement of positions in the Asia Pacific market, where sales climbed 47%. Sales volumes to the Group’s homeland market also increased by 35%, supporting the Russian agricultural sector with a high-quality product base and maximizing crop yields. A notable dynamic was a near doubling of potash shipments to the United States, sending overall revenues from the region 81% higher than the same period a year ago.

The first half of 2021 saw demand for urea in the United States and Europe ramp up, with buyers playing catch-up from slow demand towards the end of the previous year. In tandem, lower production and fewer exportable tonnes from China, as well as turnarounds in the Middle East, kept the market balance tight. In the ammonia market, tight supply was exacerbated by curtailments in Europe and Trinidad and Tobago, supply outages in Saudi Arabia and Indonesia, while higher spot demand fueled significant price increases in both the east and west. On the back of low inventories, less export availability in the Far East forced Indian phosphate producers and industrial consumers of ammonia to source volume from other locations, which supported the FOB Baltic price increase. EuroChem’s full self-sufficiency in ammonia after the successful launch of the US$1 billion EuroChem Northwest ammonia plant in 2019 has mitigated price spikes and maintained costs at acceptable levels for production of various fertilizers. Nevertheless, urea proved the main performance driver for EuroChem as it accounted for almost half of nitrogen segment sales, with sales increasing by 50% compared with 1H2020. Ammonia revenues almost tripled year on year on the back of a 90% price increase, as well as a 49% jump in product shipments. The strong ammonia price performance drove standalone LTM EBIDTA at EuroChem Northwest to US$133 million in the first half of the year.

Ammoniated phosphate prices have strengthened significantly since the beginning of the year, driven by a policy reversal in China, whose concerns over food security prompted inventory-building and improvements in application rates; US countervailing duties placed on Moroccan and Russian DAP/MAP producers; and a sharp rise in grain prices. MAP and DAP prices nearly doubled year on year, boosting Group revenues by one-third to US$1.5 billion. While countervailing duties restricted direct shipments to the United States, the Group managed to retain a significant market share through third-party product sales and excellent distribution capacities enabled by the 2016 acquisition of distributor Ben-Trei. Further mitigation included the introduction of new products to the US market through European production facilities, and the diverting of product to other locations. EuroChem remains 30% short of self-sufficiency in apatite for phosphate fertilizers, and sources the raw material from third parties in order to secure smooth production and deliver contracted volumes to end customers.

The potash market has been dominated over the period by the activity of Belaruskali. In January the company became the first supplier to agree a contract with India at US$247/mt CFR, followed by a contract with China at the same price and a number of forward sales into Latin America. Fears the contract prices in China and India did not reflect the tighter global supply/demand position appeared to be justified as by April, India was forced to renegotiate to US$280/mt to attract more tonnes. Shortness of product, coupled with exceptional crop affordability, saw granular MOP prices shoot upward in Brazil and the United States. Further fears on potential export restrictions on Belarus in the wake of political events pushed prices even higher to US$500/mt CFR Brazil by the end of the reporting period. Potash remains the key driver in the Group’s output ramp-up, with the Usolskiy mine and beneficiation plant increasing production to 1.2 MMT in 1H 2021 to meet growing demand. In the first half of 2021, sales volumes were up 25% year on year and accounted for 11% of EuroChem’s fertilizer sales mix in monetary terms.

The first six months of 2021 saw an uncertain period with iron ore prices ranging between US$150/mt and US$230/mt CFR China. Concerns about the price-eroding impacts of Chinese government intervention proved overblown, allowing trading to revert to strong fundamentals with prices trending higher on rising demand and limited supply. Steel production increased to all-time highs and steel mill margins were extremely healthy, adding to momentum and pushing prices as high as US$239/mt. A 16% boost in iron ore EuroChem sales volumes due to higher output, together with a sharp climb in prices helped sales rise 154% on 1H2020 figures. Iron ore sales volumes were almost evenly distributed among Russian local market and shipments to China.

Leverage

Net covenant debt decreased by 16% year on year, with debt portfolio optimization and a number of earlier prepayments executed. EuroChem remains in a strong liquidity position, having almost US$1.3 billion of cash on its balance sheet, which together with the jump in EBITDA drove the net leverage ratio to 1.35x.

In April 2021 Russian ratings agency Expert RA upgraded the Group’s local credit rating by two categories to ruAA.

In July 2021 S&P upgraded EuroChem’s rating to ‘BB’ with stable outlook from ‘BB-‘ on improved free operating cash flows amid a strong market, potash capacity ramp-up and adequate liquidity position.

Furthermore, EuroChem disbursed in full a US$1 billion syndicated loan facility with a pool of international banks, signed in the fourth quarter of 2020, and final closing was conducted for a non-recourse project finance facility to construct the EuroChem Northwest 2 ammonia and urea plant. The project, backed by a pool of Russian, is now fully financed by a long-term off-covenant facility with an 80% to 20% debt-to-equity ratio. A bridge loan for early financing of the project was repaid in full.

Corporate developments

EuroChem Northwest 2. The project is in its active design development stage, with initial construction underway. The Group is on track to complete the remaining works in just under two years, as stipulated in the EPC contract, which covers more than 80% of costs. Project capex spent as of June 30, 2021, stands at US$608 million, around 43% of the main project’s costs. Currently more than two-thirds of the project design work for the facility is complete. Key materials such as pipes, fittings and various accessories are being delivered and going through customs clearance, with more than 950 tonnes of the steel structures required to assemble the main parts of the plant already on site. Piling is almost complete, with work commencing on laying foundation sections. A key stage was passed with the approval of a governmental special investment contract that grants favorable conditions for the financing and delivery of the project.

Usolskiy Potash Plant. EuroChem continues to execute on the expansion of the Phase 1 facility, with the company on track to deliver a 2.7 MMT capacity plant in the next couple of years. MOP production over the first half of 2021 amounted to 1.21 MMT. Forthcoming Phase 2 expansion engineering decisions will define the product mix for Phase 2 expansion, to be commissioned in due course. The mine continues to expand, with a third shaft-sinking reaching final excavation for the shaft bottom steel. This hoist and shaft complex is on schedule to accommodate the increased mine development and beneficiation capacity.

VolgaKaliy Potash Plant. Developing VolgaKaliy beyond test production has involved a further strengthening of the Mine Planning team and the use of several senior specialists as contractors. As a result the mine plan has been adjusted and coordinated with the shaft construction schedule. A second full skip assembly will be available in due course, and the mine plan is working to be available to provide tonnage to run the mill in continuous mode at that time. Over the first half of 2021, more than 90 KMT of MOP were produced.

SaratovKaliy Potash Project. Exploration work is underway at EuroChem’s potential third potash project in Saratov in southwest Russia. Following positive analyses provided by 2D surveying, 3D seismic studies are being conducted to confirm preliminary project viability. The full feasibility study will be completed in 2022. This deposit has been explored in great detail, and the resource indications are that it will be one of the biggest deposits in the industry.

Serra do Salitre. In August 2021, EuroChem signed an agreement to acquire the Serra do Salitre phosphate project from Yara International ASA, in a deal worth US$410 million. The project comprises a 350 MMT open pit and an upstream production plant that will, when it comes on stream in 2023, add 1 MMT of phosphate production capacity through the Group’s MAP/NP and SSP/TSP product lines. The acquisition is subject to regulatory approval from Brazilian antitrust authorities. The mine and plant are located in the agricultural heartland of Brazil, in the southeastern state of Minas Gerais.

On August 27, 2021, EuroChem marks its 20-year anniversary. The company has proven to be one of the industry’s fastest risers, becoming a top-five global fertilizer producer with production and distribution assets on four continents with more than 27,000 people worldwide, all in the space of two decades.

Market outlook

Nitrogen markets look to remain tight through the second half of the year, driven by firm demand and low inventories. Global urea demand is expected to remain firm due to strong farmer economics. Indian and Brazilian demand in particular will support prices. On the supply side, limited China export availability will continue to keep the market balanced to short. The prospect of a Chinese export tax may have the effect of tightening the market further. High natural gas input costs are expected to remain a feature of the market into 2022, providing continued support to ammonia prices. Nitrates markets will remain supported by the strong overall nitrogen market dynamics.

Phosphate markets should remain firm, driven by resilient crop prices and good farmer affordability globally. India will be a key market driver. With low phosphate inventories and the government demonstrating support to the sector with a significant upward adjustment in farmer subsidies, strong demand should materialize. Combined with limited Chinese supply, the fundamentals remain in place for tight market conditions. In the West, the market continues to adjust to the change in trade flows arising from the imposition of countervailing duties.

Low inventories and strong demand will continue to support the potash market through the end of the year. Depleting Chinese stocks and increasing prices are a signal of the strength of Asian demand; this will bring forward the need to earlier settle a contract price more reflective of tight market conditions and will in turn raise other Asian market prices. Reconfigurations of North American production continue to impact sentiment in an already tight market.

In the iron ore space, supply will remain capped by logistical challenges among major suppliers in Australia, while Brazilian supply continues to deal with legal hurdles to bring back some of the country’s idled capacity. Global iron ore demand is expected to remain firm as the world outside of China continues recovering from the pandemic, and steel production normalizes. Chinese demand remains above the previous year’s levels despite government efforts to control steel production, as demand is still digesting the economic stimulus from previous quarters.

This EuroChem publication contains forward-looking statements concerning future events. These statements are based on current EuroChem’s information and assumptions concerning known and unknown risks and uncertainties.

About EuroChem

EuroChem is a leading global fertilizer producer, and one of only three companies worldwide with manufacturing capacity in all three primary nutrient groups: nitrogen, phosphates and potash. A vertically integrated company, EuroChem is expanding its mining, production and distribution capacities in key regions around the world. The company’s growth is primarily driven by the ramp-up of two large-scale potash projects and new state-of-the-art ammonia and urea facilities, and underpinned by an operational efficiency drive across the full value chain. The Group has key manufacturing facilities in Russia, Belgium, Kazakhstan, and Lithuania, employing more than 27,000 people in 40 countries, and with a product reach of more than 100 countries.

For more information, please visit www.eurochemgroup.com. Any media or analyst enquiries should be directed to the appropriate EuroChem Group contact, as listed below:

INVESTORS

Oxana Kovalenko

Head of Investor Relations

EuroChem Group AG

oxana.kovalenko@eurochemgroup.com

MEDIA

David Nowak

Deputy Head of Communications

EuroChem Group AG

david.nowak@eurochemgroup.com

RUSSIAN MEDIA

Vladimir Torin

Head of Public Relations

MCC EuroChem

vladimir.torin@eurochem.ru